With its total market cap exceeding $10 Billion in May 2020, stable coins are becoming increasingly popular with investors in the cryptocurrency space. Stable coins are typically tokens issued on a cryptocurrency blockchain like Ethereum and are backed by reserves - commodities, fiat currencies or other cryptocurrencies. This offers holders a guarantee of price stability with the coins pegged to an external store of value such as the USD which means that each coin can theoretically be bought or sold for 1 USD. However, stable coins are not without their risk as can be seen in the controversy surrounding the popular USDT (Tether) stable coin.

In this article, we analyze 5 popular ERC20 stable coin - TUSD, USDT, PAX, USDC and BUSD. Through a combination of time series analysis and network plots, we characterise their growth trajectory and highlight key patterns and behaviours.

Stable coins have garnered increasing popularity over the past 2-3 years and the number of unique users has increased significantly ever since late 2019 reaching a high in May 2020. The occurrence of COVID did not seem to be slowing down the use of stable coins as the number of unique users is the highest they have ever been over the last few months, a testament to its stability in a volatile time.

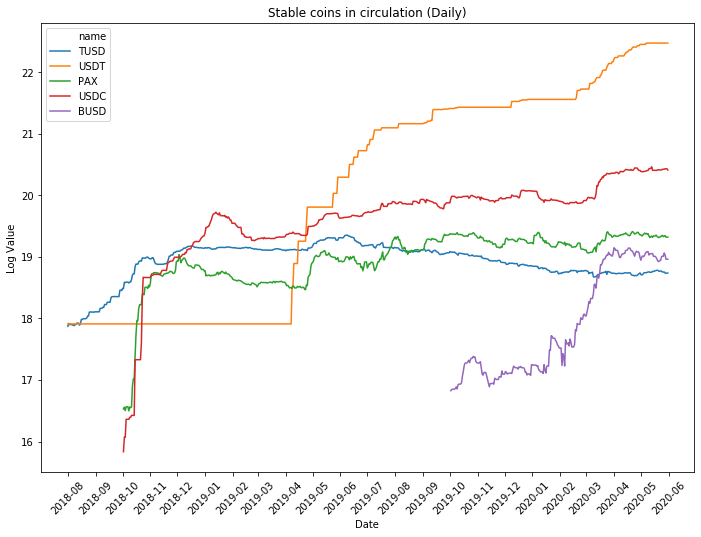

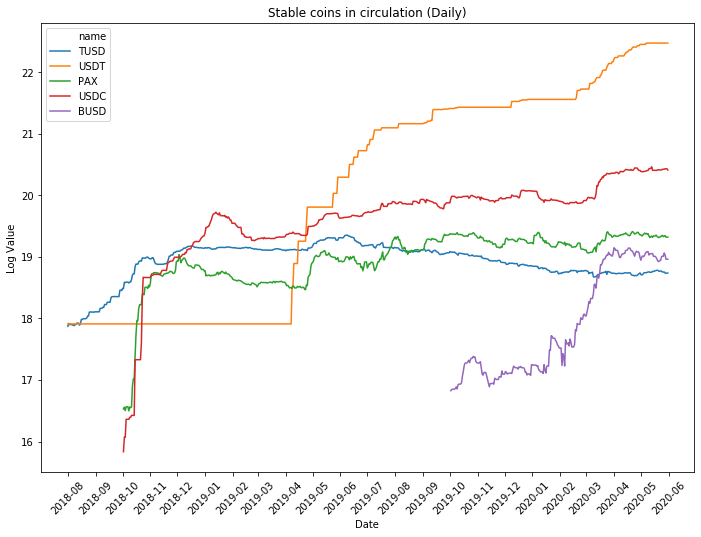

The market capitalization plot (log) shows how the amount of stable coins in circulation has grown over the years. Market capitalization of USDT, has been on an upward trend since April 2019. USDC, PAX follows a gradual upward trend while TUSD has remained relatively stable over the past months.

A plot of the monthly transaction volume of the top 3 stable coins over time is shown below. It can be seen that only in March 2019 did USDT gain vast popularity, with transactions reaching as high as 35 Billion one year later and continuing on its uptrend.

What catalyzed the growth of stable coins? We break down the transaction flow over time using a network plot. The plots here arrange Ethereum addresses as nodes in a circular layout with each edge representing a transaction between 2 addresses. Nodes are coloured based on the exchange they are associated with, nodes in green representing Binance addresses, nodes in cyan representing Huobi addresses and nodes in pink representing untagged addresses and other less popular exchanges. The plots are initialised at the beginning of 2018, with repeated quarterly intervals for the plot below. Towards the latter part of 2018, edges were bundled to reduce visual clutter. The density of the edges represents flows from one region of the network to another.

The plots show the key role of exchanges such as Binance (Green) and Huobi (Teal) in popularising stable coins. Stable coin activity was relatively muted at the beginning of 2018 and concentrated across several addresses. Trading activity started to pick up towards the end of 2018 / start of 2019, with numerous transactions originating from Binance and Huobi related wallets. As the popularity of stable coins grew, non-exchange addresses began holding and transacting these tokens as well, creating more links across the network.

Enjoying the content?

Subscribe to get updates when a new post is published

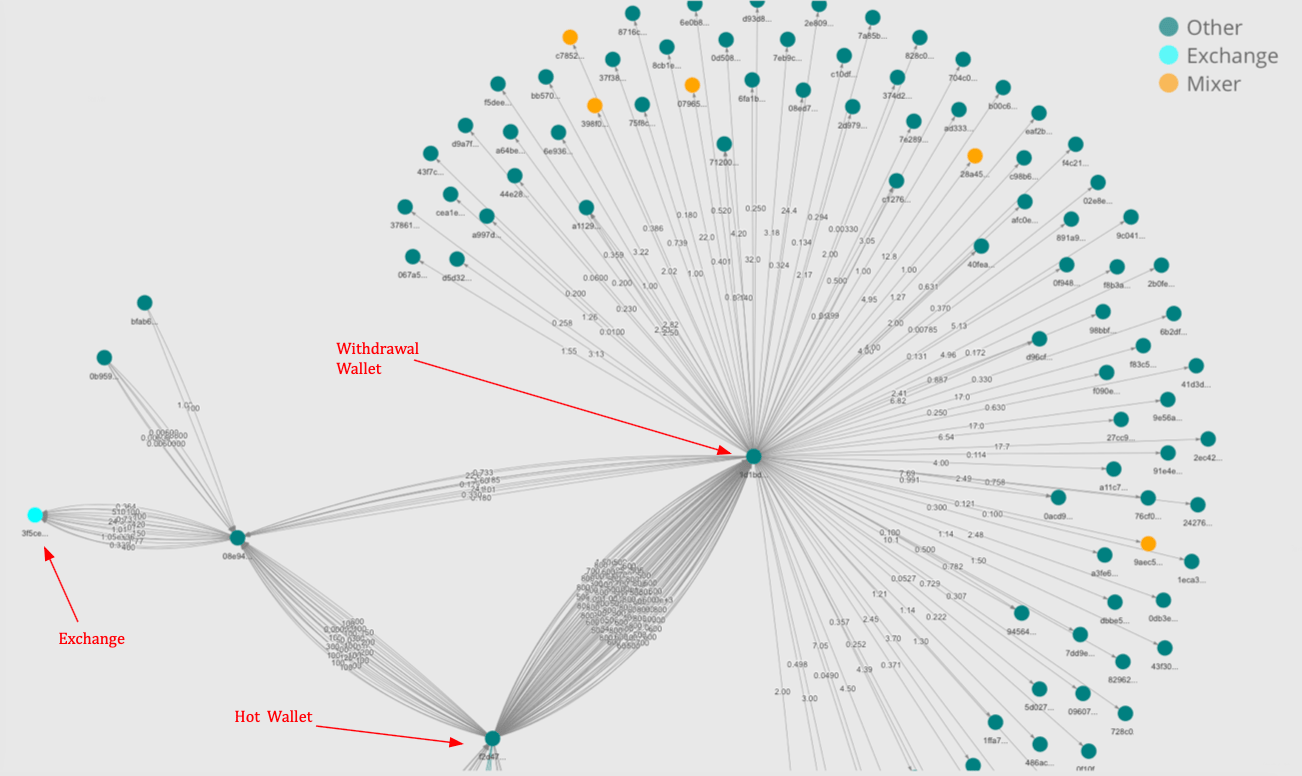

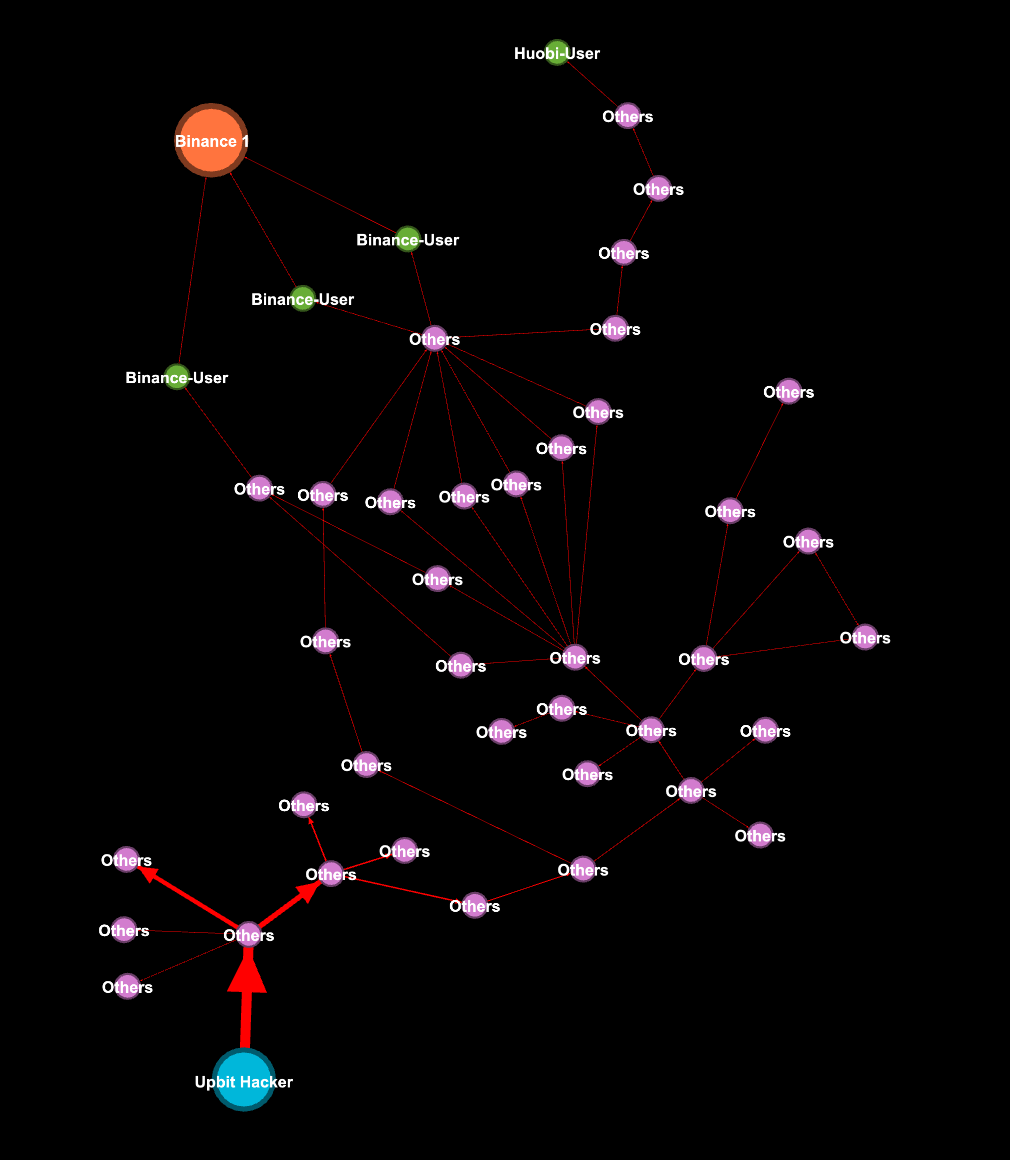

Alternatively, we aggregated all addresses which were associated with an entity as a single node and plot the resulting network using a force-directed algorithm. In the graph below, edge thickness represents the number of transactions between the 2 entities and the node size represents the total number of outgoing transactions of that entity.

Unsurprisingly, we see Binance and Huobi being very central in the graph. They are also closely linked with exchanges such as Okex and MXC. The core of the graph consists of the major exchanges as well as crypto-finance players such as Nexo, Celsius Network and Blockfi, which have popularized the concept of crypto lending and borrowing over the past year.

Summary

It is undeniable that stable coins have increased in popularity over the past few years and are predicted to continue increasing in the future. At Cylynx, we are expanding our entity coverage and transaction surveillance to include stable coins and tokens. Do contact us if you are looking for additional insights or data to analyse the transaction patterns of stable coins.

Enjoying the content?

Subscribe to get updates when a new post is published