Introducing Cylynx Cryptocurrency News API

Cylynx Cryptocurrency News API automatically scrapes news sources and generates risk scores, making risk information on crypto-entities readily available and accessible.

Cylynx

August 03, 2021 · 4 min read

Cylynx Cryptocurrency News API automatically scrapes news sources and generates risk scores, making risk information on crypto-entities readily available and accessible.

Cylynx

August 03, 2021 · 4 min read

Cryptocurrencies such as bitcoin and ethereum have been increasing in popularity, with use cases ranging from monetary transactions to crypto-collectables in the form of non-fungible tokens (NFTs) such as CryptoKitties and Axie Infinity.

While this innovation is a boon for the crypto-community, investors and regulators who are monitoring the space face the struggle of keeping up with new projects, organizations and tokens. This is especially relevant for risk surveillance, where having quick access to accurate risk information is vital in decision making and planning.

We have recently released our Cryptocurrency News API to make risk information on crypto-entities readily available and easily accessible. Continue reading on to discover its features, use cases and how it works. If you are interested in integrating it into your own product, feel free to drop us an email.

With so many different news platforms, monitoring the various platforms and news articles is a tedious process. If done in-house, a staff has to constantly visit different sites to keep up with the news which takes a lot of time and effort.

On the other hand, while news and risk monitoring can be outsourced to other companies, this may be an expensive and ineffective solution. Most media monitoring companies are targeted towards social media monitoring and social listening, and are not specialized in the field of cryptocurrency. They monitor trends, customers, competitors, etc. As such, it may be difficult to find a media monitoring company that suits the needs of crypto news and risk monitoring.

At Cylynx, we build tools and solutions to help facilitate data monitoring, exploration and analysis. After considering the challenges and needs of crypto news and risk monitoring, we created the Cryptocurrency News API to help make the process less tedious and more efficient.

The API automatically scrapes news sources and generates risk scores using a sentiment analysis model trained on crypto news sources, allowing you to easily track crypto news and risks. It has various features such as generating risk sentiment scores, name entity recognition, top articles, and average risk.

We created the Crypto News API to help users easily keep up with relevant news, gauge risk at a glance with risk scores, and quickly view the most relevant articles related to an entity of interest.

The Crypto News API currently supports automated risk monitoring of popular open-source news websites, with social media sources in the works.

Value-added service providers (VASP) looking to comply with existing regulatory requirements and automate know your customer checks (KYC) using open source information will find the API feed useful. Investors looking to monitor the companies which they invest in would also benefit from automated news monitoring.

Using our API, engineering teams can easily construct their own comprehensive monitoring and alerting system or integrate the API with existing products. The API along with monitoring and alerts is also included as an out of the box solution as part of our Blockchain transaction monitoring solution.

One-stop-shop for crypto news from various sources

Our Crypto News API provides a repository of articles collected from various news sources such as Cointelegraph and Coindesk for various crypto-entities such as crypto-exchanges, custodians, currencies or tokens. Instead of having to search separately on all these sources, they are integrated into one API.

Gauge risks at a glance with risk scores

Using Natural Language Processing (NLP) sentiment analysis, our solution performs risk scoring (0 - 100) on the articles. NLP is a form of artificial intelligence that allows machines to read, understand, and derive meaning from human languages. By using NLP for sentiment analysis, the API can score the articles and provide a risk score for each of them. The API is also able to provide average risk scores for various sources over a selected date range.

Entity filtering

Using Named Entity Recognition (NER), we filter out important entities within text excerpts and allows the user to see at a glance which subjects have appeared frequently in crypto news over a certain period, facilitating greater risk monitoring.

Flexible Querying

With customizable endpoints to retrieve data, our Crypto News API is able to suit the different needs of the user. Users can choose to query the articles by time range, entity, news source, or by text filters to sieve out the required information.

Users can specify parameters such as start and end date, as well as specific sources or entities of interest, to retrieve the relevant articles and their related risk sentiment scores.

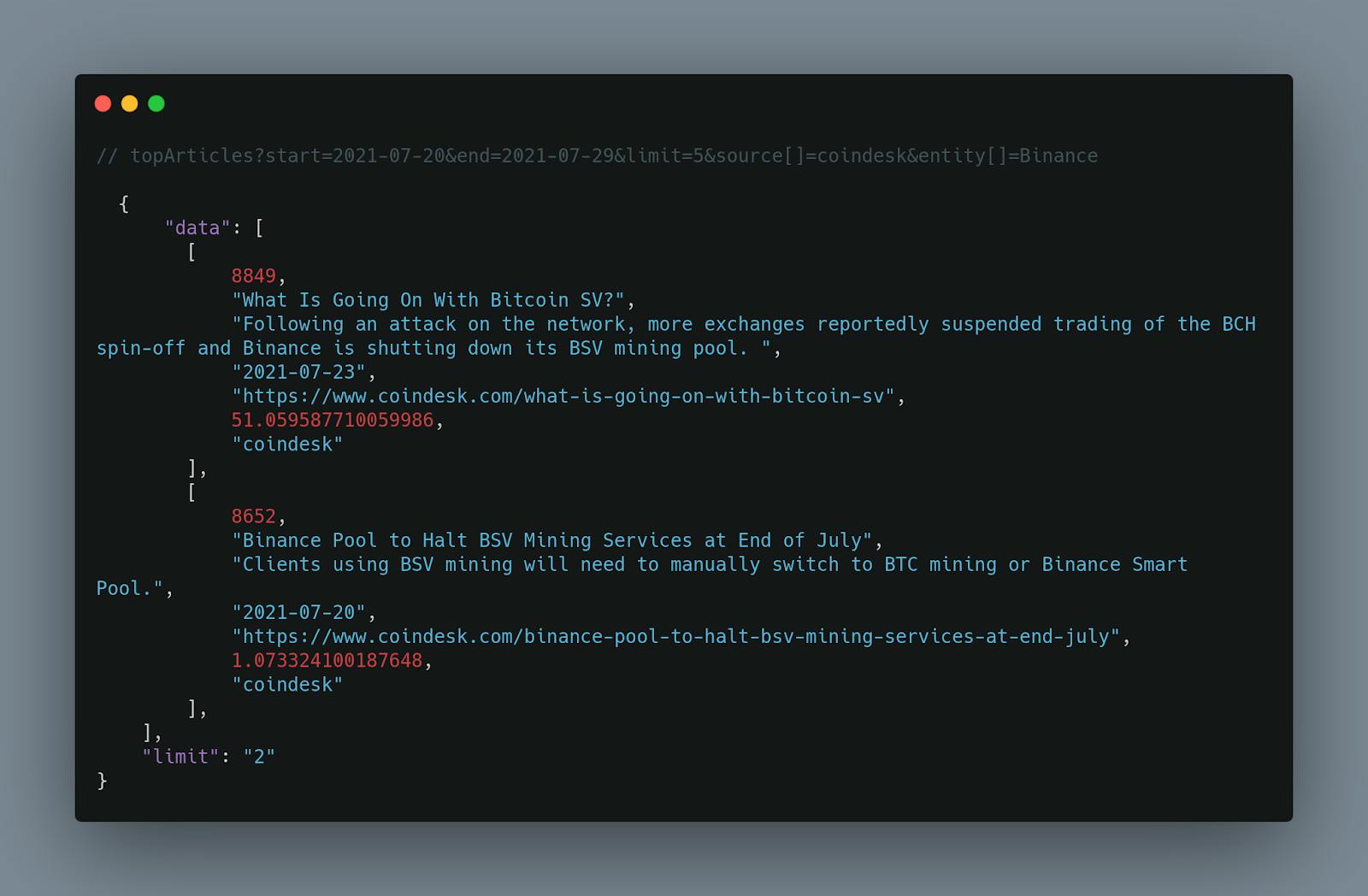

This endpoint retrieves the top articles sorted by risk scores in the specified time range. A limit parameter is included to allow the user to decide how many articles per day he / she would like to retrieve using the API. Similar to the Risk Score endpoint, sources and entities can be chosen to narrow the scope of the article data.

Given a certain text input, the algorithm predicts an associated risk sentiment value ranging between 0 and 100. The closer the value is to 100, the higher the risk.

Entity recognition highlights the subjects of interest / organisations within the article — for example, ‘Binance’ and ‘Bitcoin’. The predictions of these entities are tagged with a corresponding score that indicates the confidence level of our algorithm’s prediction.

With cryptocurrency being more popular and widespread, there is a rising need to monitor crypto news and risks. We are proud to release our Crypto News API to empower users to monitor crypto news and risk easily.

You can read more and try out the API here. If you have any queries or feedback, feel free to contact us through our contact form.