Exchanges are a very important service category of the cryptocurrency economy and are responsible for the movement of the majority of virtual assets within a cryptocurrency as well as being the gateway for crypto-to-fiat conversions. Retail or centralized exchanges are the most prevalent type of exchanges with users trusting in these companies to manage their private keys and coins. Some examples of centralized exchanges are Binance, Kraken and CoinBase. While exchanges offer speed and convenience, users are at their mercy if and when a hack happens.

Being the central gateway in the cryptocurrency world, it is surprising how little work has been done to characterise the structure of exchanges. This includes their governance structure, how they receive funds and carry-out transactions on behalf of their users. Understanding the structure of exchanges will help users make a more informed choice based on how their assets are being managed. As a cryptocurrency forensics company, this knowledge also helps enrich our crypto-entity resolution and forensic capabilities.

Drawing references from a past study on Bitcoin transactions on different exchanges, we look into transactions on the Ethereum chain as performed by these centralized exchanges. Before we dive deeper into the structure of these exchanges, let’s do a short summary of the types of wallets typically operated by an exchange. The wallets owned by an exchange can be classified into 4 general types:

Centralized Crypto Exchanges

Deposit Wallets: Exchanges often provide user-specific deposit wallet addresses to facilitate transfers to the exchange.

Withdrawal Wallets: Withdrawal wallets are used by exchanges to transfer funds out of an exchange. In Etherscan, the withdrawal wallets are often tagged as the exchange’s main wallet .

Hot Wallets: Hot wallets are online wallets which exchanges usually store a portion of their funds in. The exchange will often ensure that there are sufficient funds in their hot wallets for daily transactions.

Cold Wallets: Cold wallets are offline wallets whereby a physical medium is used to store the private keys. Exchanges usually store a large amount of their funds not intended to be traded often in cold wallets.

Visualization Of General Topologies In Crypto Exchanges

With some background knowledge of the main wallet types, let’s take a look at the structure of the exchanges!

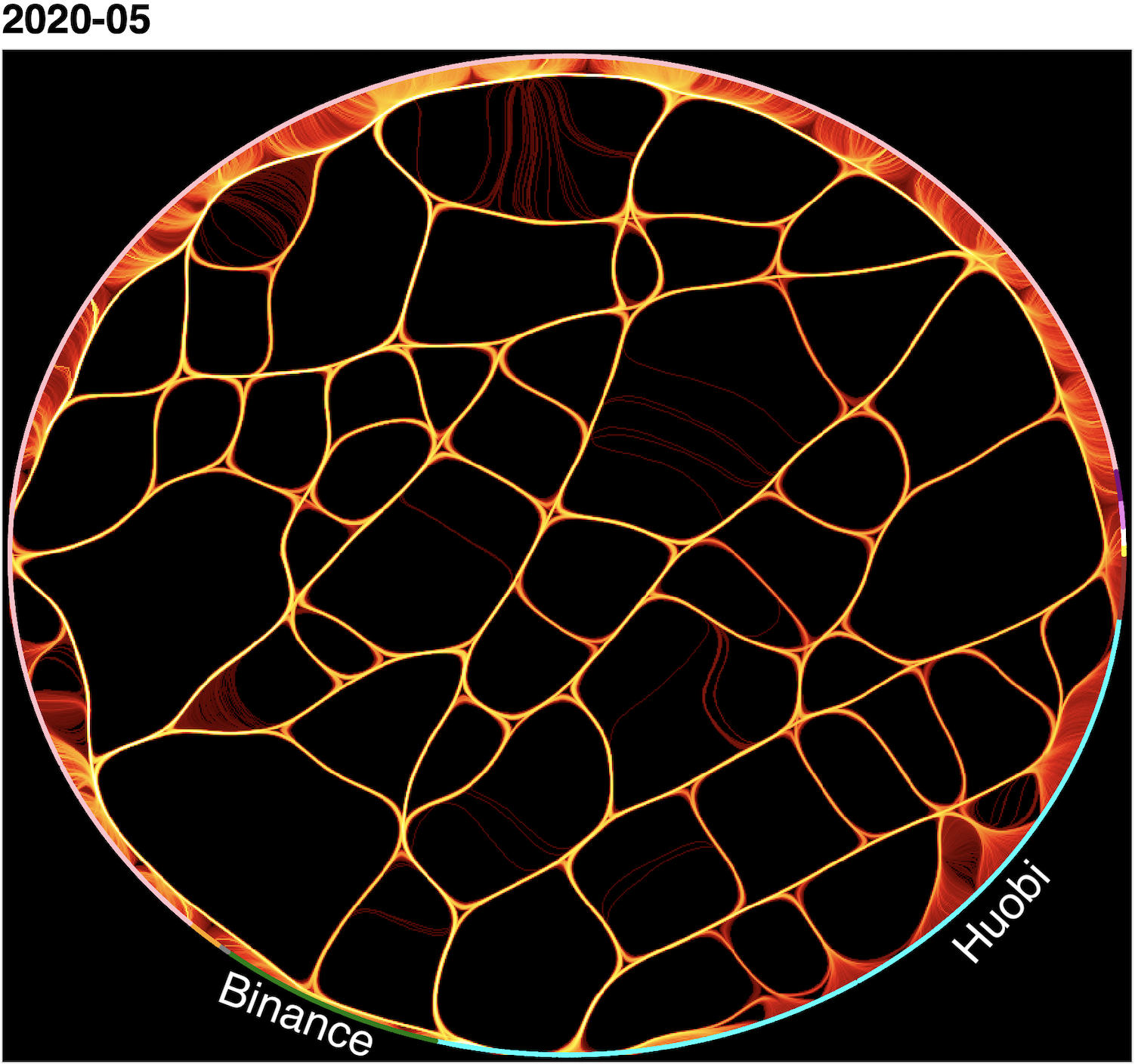

Results are visualised using our Blocklynx tool. The entities tagged as exchanges are those found from public sources. Additionally, we manually interacted with the exchanges to collect more information on how they are structuring their operations. Addresses tagged as mixers are suspected mixer accounts (addresses which are made to hide the trail of assets), while those tagged as others could not be tied back to any public sources.

Enjoying the content?

Subscribe to get updates when a new post is published

We present some common typologies from our analysis. These typologies are grouped into 3 general categories - user deposits, withdrawals, and exchange-to-exchange transactions.

1) USER-TO-EXCHANGE TRANSFERS (DEPOSIT)

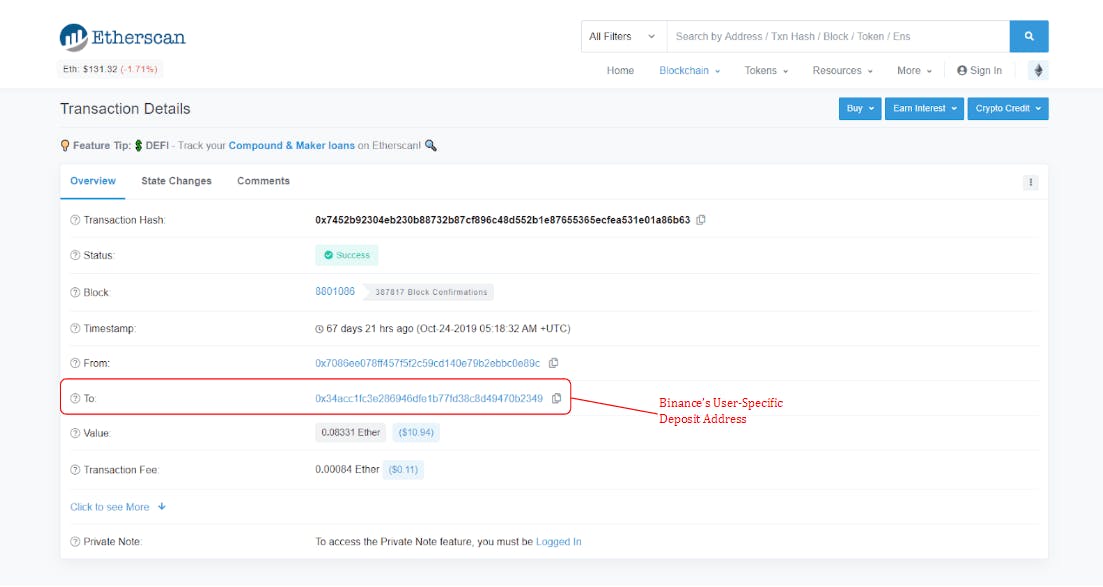

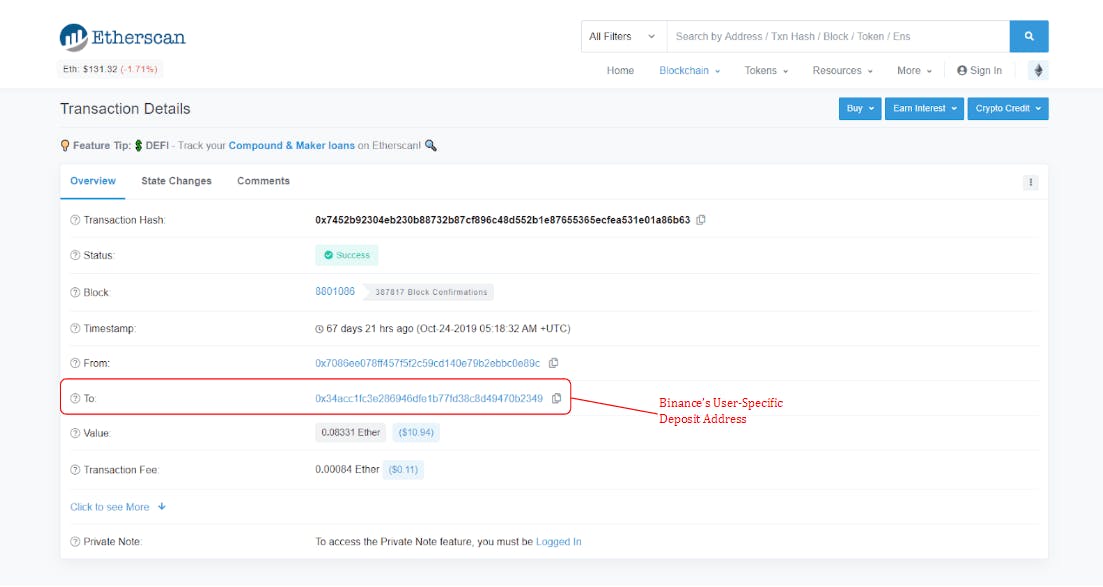

Most exchanges including Binance and CoinHako provide user-specific deposit addresses to facilitate transactions into the exchange. We can make use of the Etherscan platform to trace the trail of a transaction. The transaction details can be found on Etherscan, where the transaction hash and the wallets involved in the transaction are included. We show an example of how we can trace a deposit transaction made by a user to Binance.

Transaction Details of a Deposit into Binance

Transaction Details of a Deposit into Binance

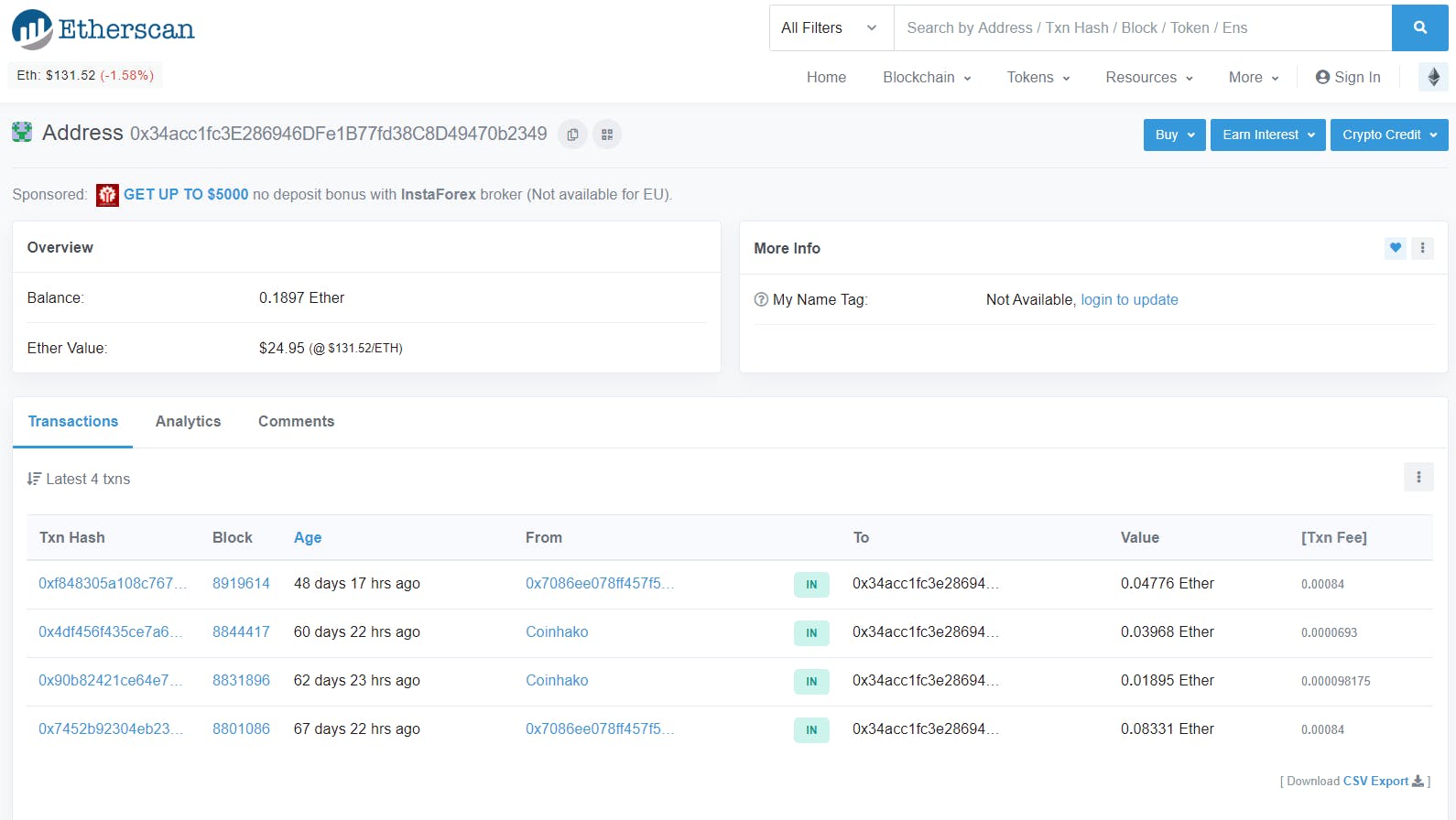

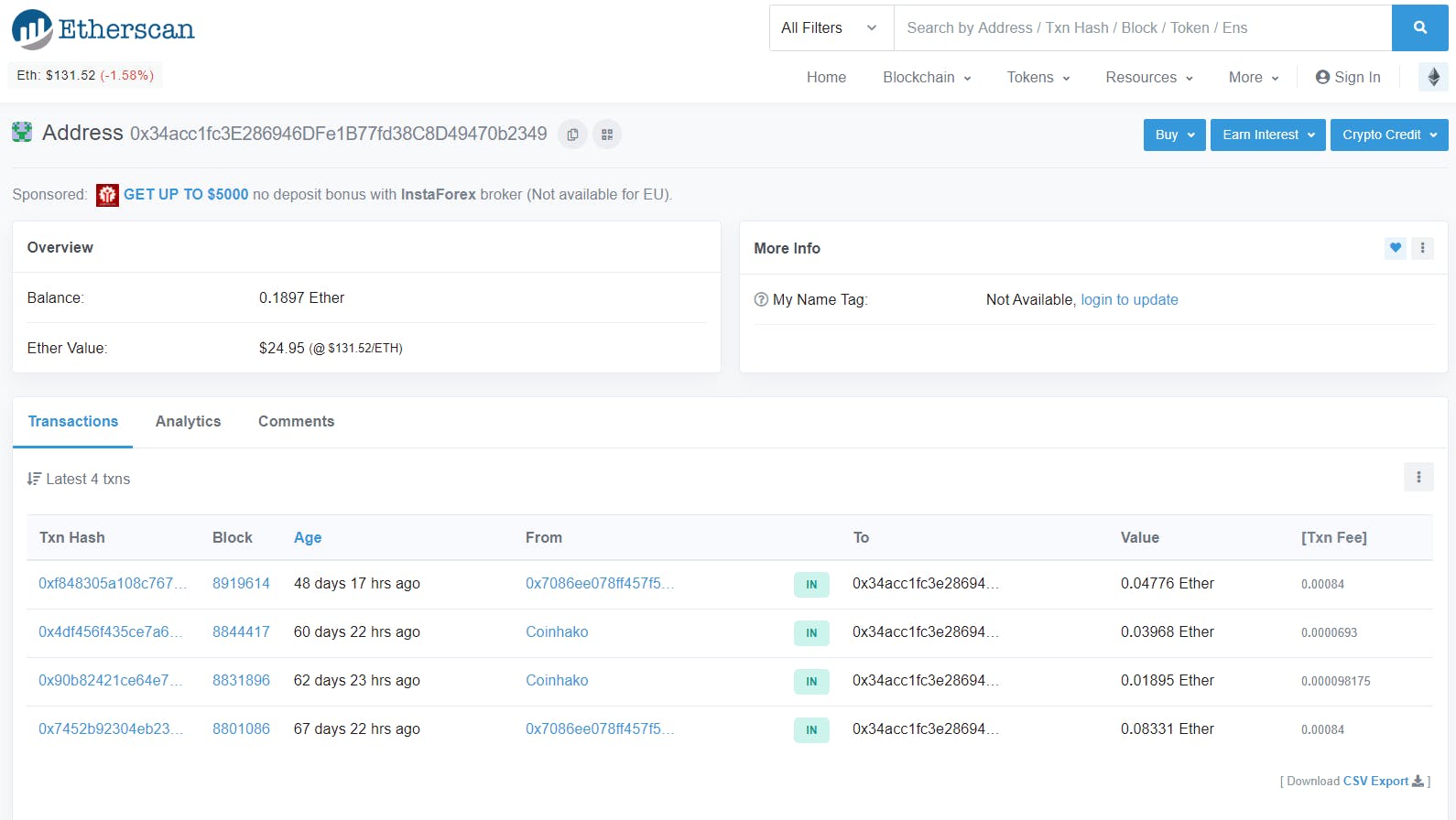

Transactions of a Binance’s deposit address

Transactions of a Binance’s deposit address

In Binance case, the deposited funds remained in the deposit wallet, and are not moved to any other wallets. Instead, Binance manages its own internal database to keep track of its customers’ balances.

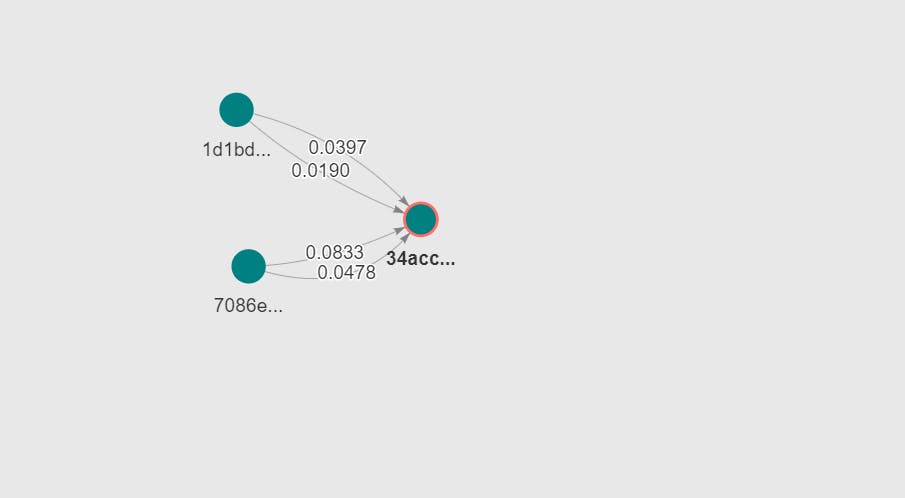

The same transaction can be visualised with the Blocklynx tool, which allows us to visualise the transactions involving the deposit address. It also comes with additional filters and visualisation options to help speed up investigative work.

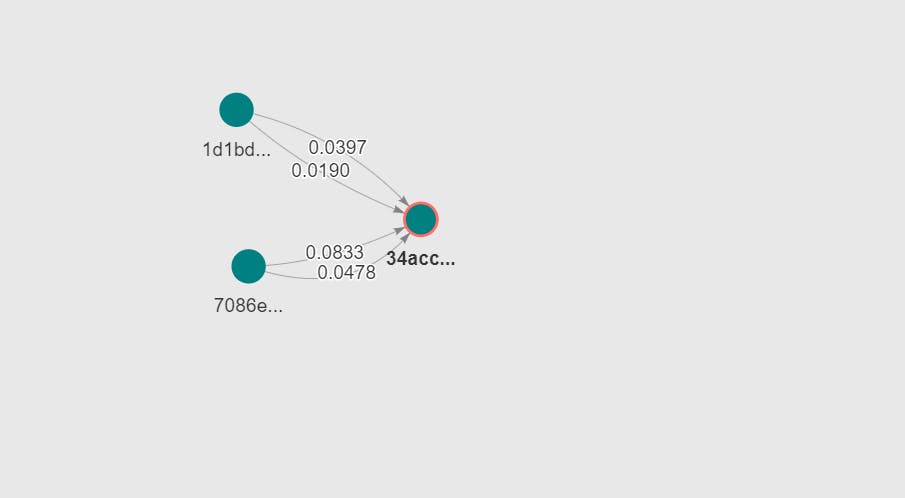

Transactions involving the Binance’s user-specific deposit wallet

Transactions involving the Binance’s user-specific deposit wallet

The exchange’s deposit wallet is highlighted in red, and the visualization shows that this wallet is only used for deposit purposes, as the funds transferred to this wallet are not transferred into other wallets.

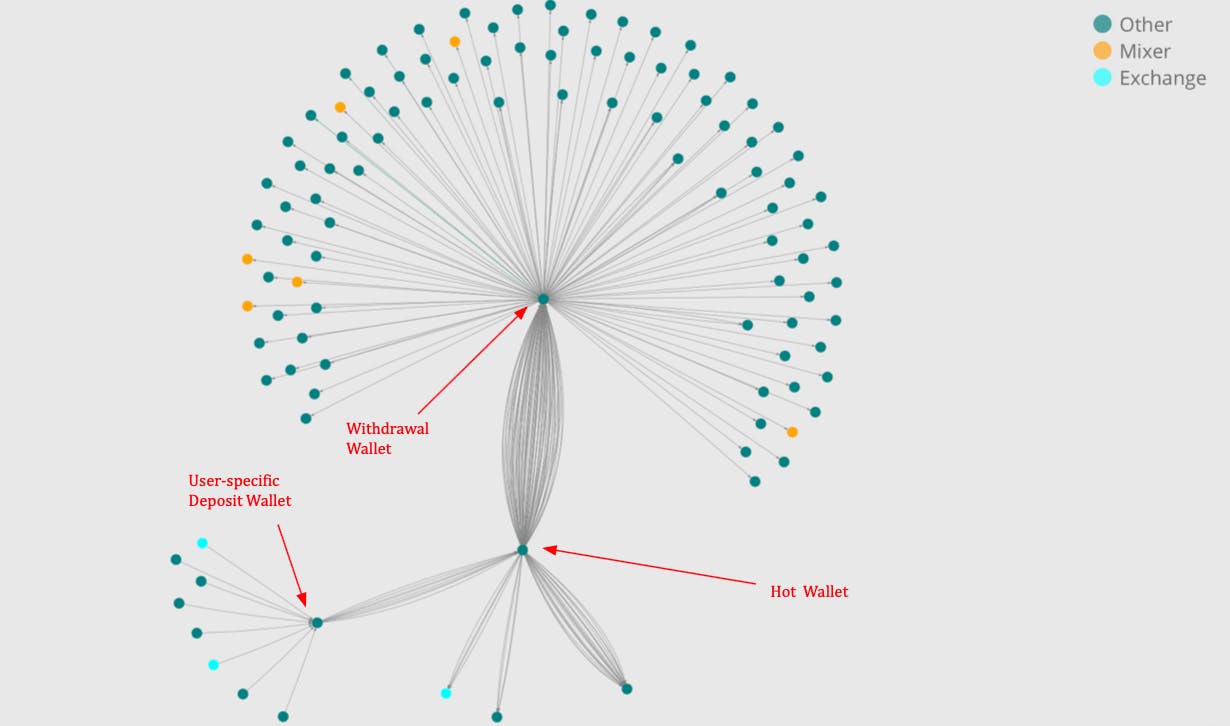

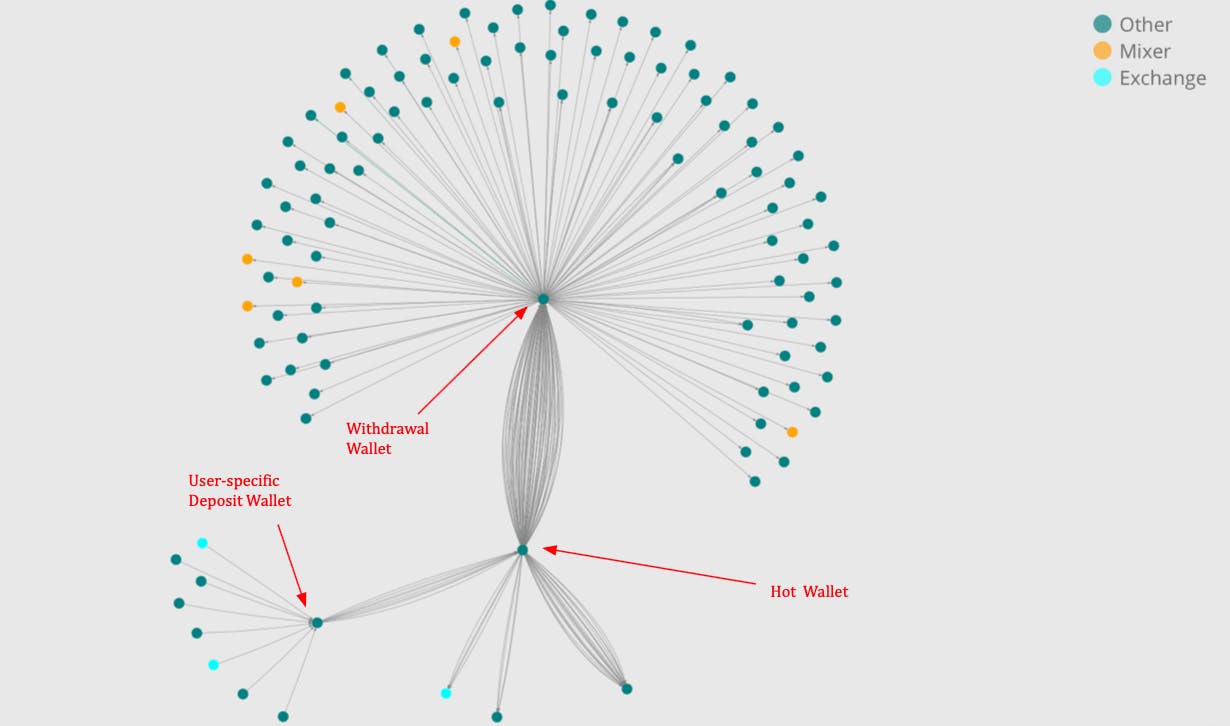

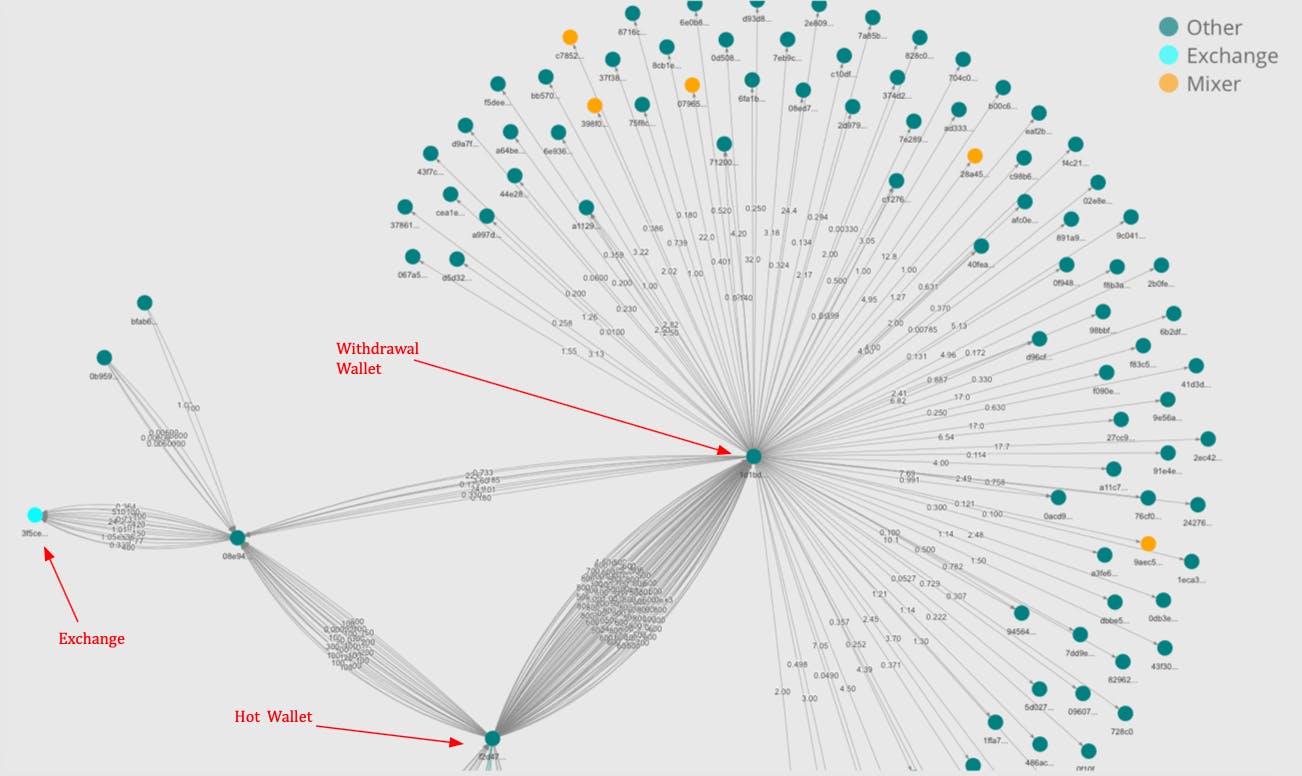

For smaller exchanges such as CoinHako, the funds transferred to the deposit wallet are subsequently transferred to the exchange’s hot wallet. The funds in the hot wallet are then bundled up in a single transaction before transferring to the exchange’s main wallet (usually a large value transfer).

Transactions involving an exchange’s hot wallet and withdrawal wallet

Transactions involving an exchange’s hot wallet and withdrawal wallet

2) EXCHANGE-TO-USER TRANSFERS (WITHDRAWAL)

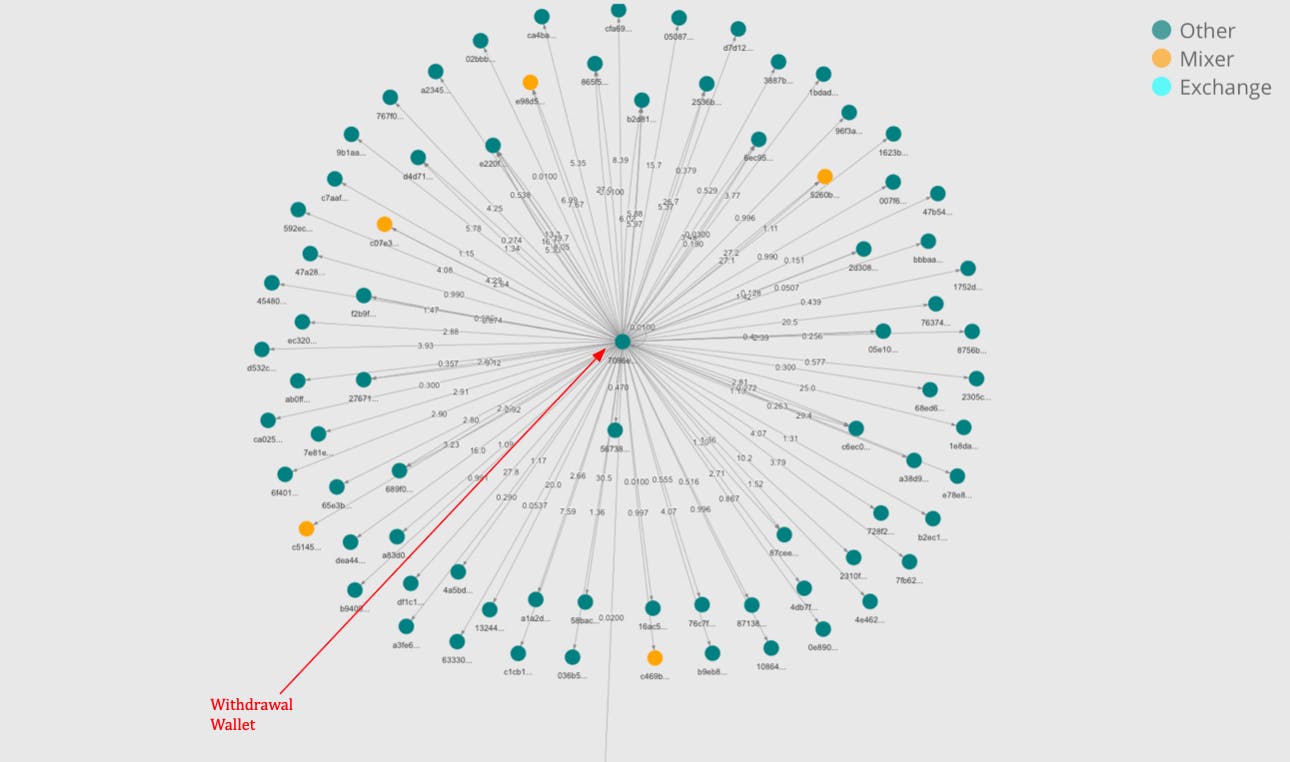

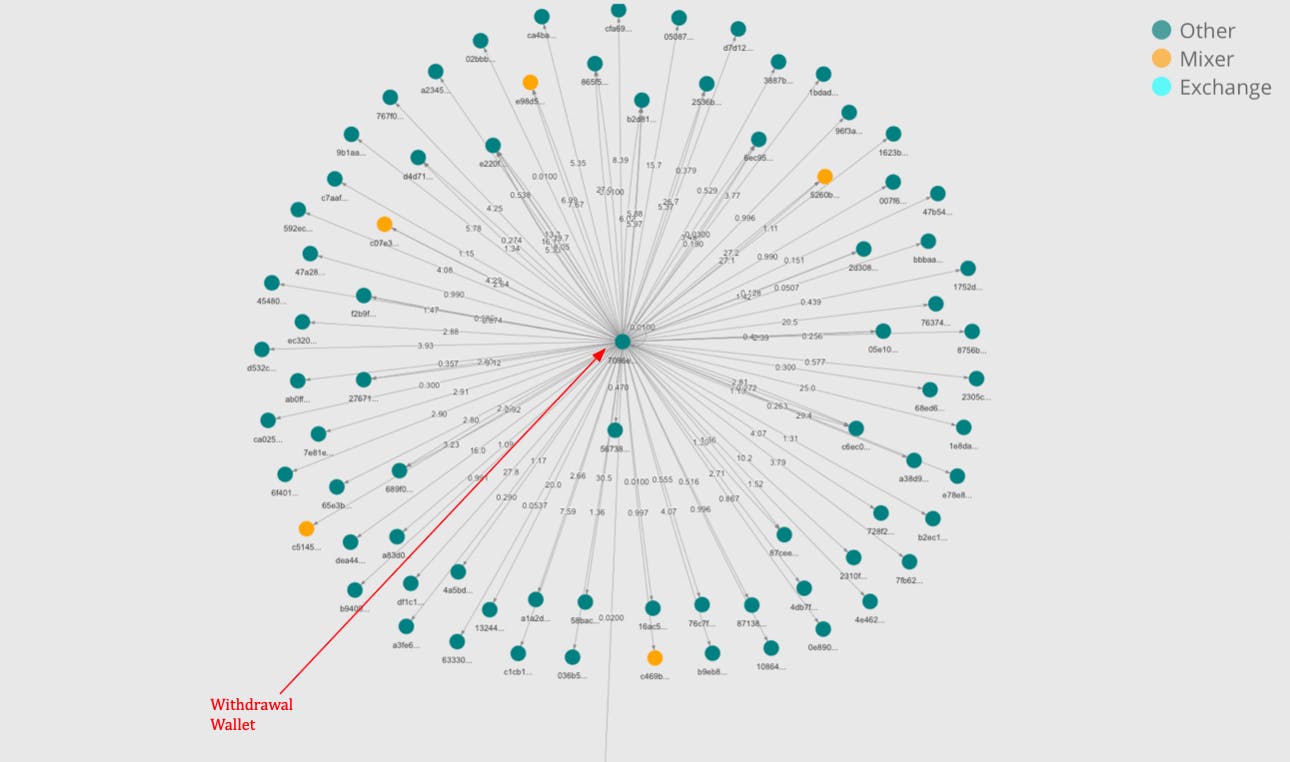

For some exchanges such as Binance, its main wallet acts as a withdrawal wallet and funds are withdrawn from it directly. These wallets tend to have a large volume of transactions.

Transactions involving an exchange’s withdrawal wallet

Transactions involving an exchange’s withdrawal wallet

Other exchanges favour a more distributed structure, with individual withdrawal wallets created for each transaction or even several hot withdrawal wallets which acts as intermediaries before a final withdrawal is carried out. Using multiple intermediary wallets offers more security and privacy for the users but could come a higher transaction fee cost and trade-processing time.

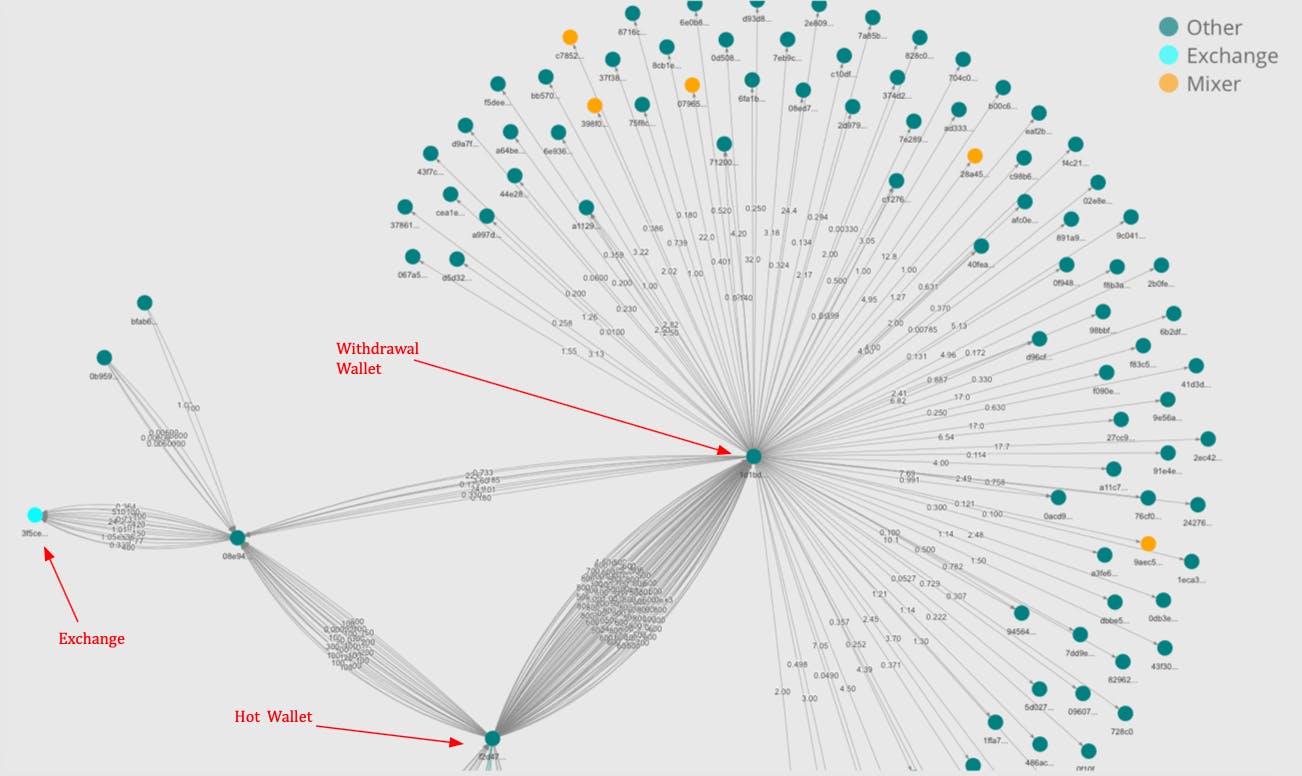

3) INTER-EXCHANGE TRANSFERS

Where do exchanges get their coins from? Unfortunately, they can’t print their money like central banks (though they can issue tokens). The nice thing about the blockchain is that we have a full ledger of transactions conducted by an exchange. This means that we are able to check on any coins transferred and validate the amount sent as well as the origin of funds.

One source of liquidity is other exchanges themselves. Inter-exchange transfers usually involve the exchanges’ main wallets or hot wallets. In the diagram below, we visualise an occasion where funds were transferred out of an exchange A’s withdrawal wallet to an intermediate wallet, before deposited into exchange B’s main wallet.

Inter-exchange transfers

Inter-exchange transfers

We hope that you found the inaugural blog post interesting and informative. Feel free to give it a try. We have opened blocklynx for alpha testing and welcome all user feedback. Sign up for an account and let us know what you discover about your favourite exchange!

Enjoying the content?

Subscribe to get updates when a new post is published

Transaction Details of a Deposit into Binance

Transaction Details of a Deposit into Binance Transactions of a Binance’s deposit address

Transactions of a Binance’s deposit address Transactions involving the Binance’s user-specific deposit wallet

Transactions involving the Binance’s user-specific deposit wallet Transactions involving an exchange’s hot wallet and withdrawal wallet

Transactions involving an exchange’s hot wallet and withdrawal wallet Transactions involving an exchange’s withdrawal wallet

Transactions involving an exchange’s withdrawal wallet Inter-exchange transfers

Inter-exchange transfers